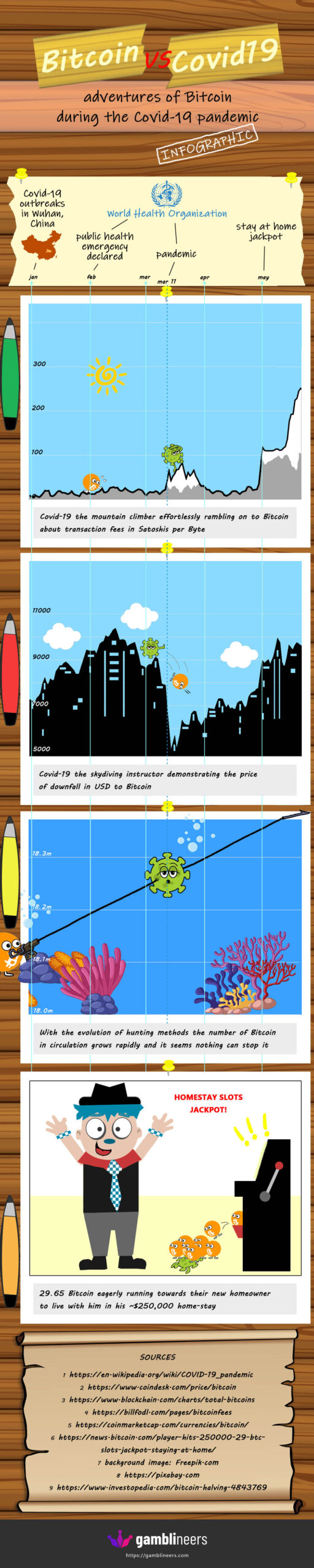

Infographic: Bitcoin vs. Covid-19

Adam Gros / Sep 05, 2022

The first questions began popping up on Bitcoin forums, blogs and news sites: “Will this affect Bitcoin?”, “Is the price going to drop?”, “Will Bitcoin prevail?”

About a month later, when the World Health Organisation declared a world pandemic, Covid-19 left its first imprints on Bitcoin charts and values.

For those of you who are experts in the Bitcoin community and those who follow Bitcoin’s price fluctuations for the sake of your own coin’s future, you probably already know at least some of the information pictured below. As a summary, we created the following whimsy cartoon infographic: Bitcoin vs. Covid-19 – Bitcoin’s journey through the Covid-19 pandemic.

A strange flue-like virus first appeared in Wuhan, China at the end of December 2019. As the first month passed we witnessed the virus rapidly spreading across the world. On January 30 the World Health Organisation (WHO) declared a public health emergency and the virus became globally known as the Covid-19.

Through February everything from panic to confusion engulfed every corner of the Earth, including the world of Crypto; this went on until March 11 when the WHO declared a world pandemic.

The impact on Bitcoin by the March event was evident:

1. Bitcoin transaction fees jumped from 16 Satoshis/Byte (March 1 to 11 average) to 60 Satoshis/Byte (March 12 to 22 average), an average increase of 44 Satoshis/Byte.

2. Bitcoin price dropped from averaging around 8,850 USD during the first week of March to below 5,000 USD after March 11 – almost a 4,000 USD decrease.

3. The increasing number of Bitcoins in circulation did not show any effect from Covid-19, which was expected as mining new Bitcoins has no reason to slow down or stop unless there was a global power outage.

And if all these changes might have frightened so Bitcoin enthusiasts, let me assure you that things soon began diverting back to normal. By the end of March, Bitcoin transaction fees were back to normal and the price started to grow back again, reaching the previously satisfying values as early as May.

The large increase of Bitcoin transaction fees at the end of April is not related to the Covid-19 conundrum – it is a consequence of Bitcoin’s third reward halving (every 210,000 blocks mined, or about every four years, the reward given to Bitcoin miners for processing transactions is cut in half), which was scheduled for May 11.

And our last but not least interesting and somewhat comforting news is this: home-stay slots jackpot won at the beginning of May. The price amounted to a staggering 29.65 Bitcoin, earning the winner about 250,000 USD. The winner remains anonymous. It is great to see that the quarantine brought some luck to someone!