Shall We Thank The Federal Reserve for Our Cryptocurrency Profits? Is there a correlation between the growth of the cryptocurrency market cap and how much money is being printed?

Adam Gros / Sep 02, 2022

The Inflation Risk Requires for a “Store of Value”

Financial events are not islands; every major shift in a financial market is likely to have an echo worldwide. So, it is natural to assume that the Fed’s decision to pump trillions into the system to support stimulus requirements for citizens impacts global financial markets in more ways than one.

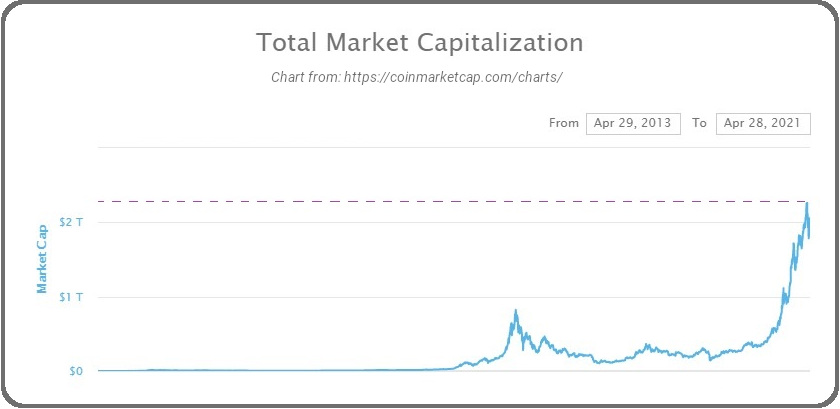

Can the wave be so powerful as to cause the massive surge in the crypto market cap? There is no consensus on this, just as there seems to be no consensus on the consequences of printing hundreds of billions of dollars out of thin air.

Some analysts predict hyperinflation. Others see the measure of printing trillions as the lifeboat that can save world economies from collapse, with no significant long-term consequences.

While some apocalyptic predictions might be too out there, it is safe to say that the Federal Reserve will have a hard time trying to maintain the inflation rate around the 2 % current target. Too many unknowns threaten to destabilize an already weak economy after more than 13 months in the pandemic.

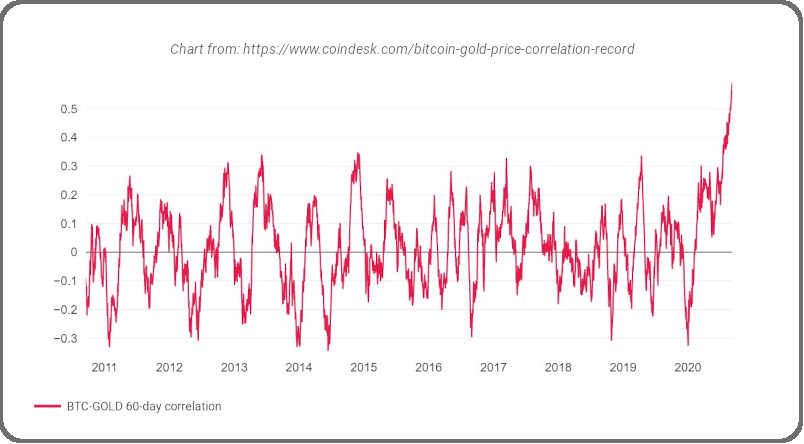

When inflation or the threat of inflation hits, the natural move is to put your money in assets that are most likely to outperform the market. Usually, it means gold, commodities, real estate, and Treasury inflation-protected securities (TIPS). In 2020, BTC managed to gain investors’ trust and convinced them of its ability to outperform the market.

Bitcoin’s Correlation With Gold Hit Record High in 2020

The BTC market cap started to grow after September 2020. After a relatively weak performance — in line with all other financial markets — the increasing demand for Bitcoin put its price upward.

Multiple events could have triggered the market’s appetite for Bitcoin in particular and cryptocurrency as a whole. Here are some of them:

- Predictions about Bitcoin price soaring to $300,000 within five years with or without Wall Street’s support gave wings to small investors.

- In September 2020, the US was already struggling with the second wave of the pandemic; more and more people began to understand that the economy would take even more hits by the end of the year.

- About the same time, Bitcoin was reaching an impressive milestone: its correlation with gold hit a record high, making it clear for many doubters that BTC was not a get-rich-fast scheme but a “heaven asset” like gold.

All these happened in a particular political climate. With presidential elections to come, the US population was divided, and uncertainty was hitting alarming records. When speculations about a new stimulus bill popped up, folks went back to cryptocurrencies to store value.

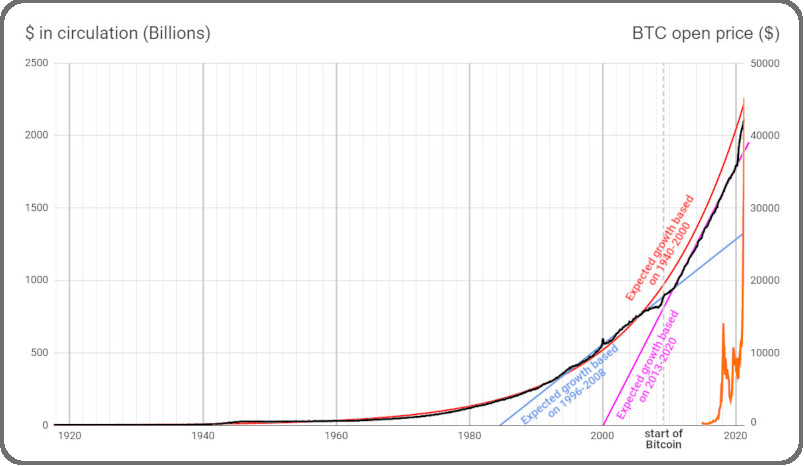

Printing more money increases public debt

By deciding to print trillions, politicians change the value of our money. While trying to “support the economy,” they manipulate inflation rates, influence currency performance, and increase public debt. With every billion that the Fed injects into the economy, the burden on taxpayers is getting heavier and scarier.

In the US, public debt has been increasing alarmingly since the beginning of the 2000s. In 2009, when Satoshi Nakamoto created Bitcoin, we finally got the chance to store value in a way independent of political decisions. A peer-to-peer paying system that does not rely on centralized intermediaries is less likely to be influenced by the shenanigans powered by governments and central banks.

The more that public debt is growing, the more money people might invest in cryptocurrencies to protect themselves from seeing their wealth losing value by the hour. While there is no official correlation between cryptocurrency price evolution and public debt, the charts speak for themselves: The more the public debt goes up, the more the BTC price is expected to grow as well.

Governments Can Print Money, But We Can’t Print Savings

The secrecy around the “big money” makes it difficult for anyone to protect their wealth during a crisis. The huge gap between understanding how finances and investment work and knowing what happens behind closed doors of banks and governments leads to mistrust.

We rely on analysts to read the data for us and guide our decisions because we are skeptical about central authorities. People look for alternatives because of the lack of transparency on where these trillions are coming from and what supports central banks to print money day and night to cover deficits.

It isn’t just about a handful of early adopters who want to protect their savings against possible inflation anymore. Small and not-so-small investors have turned to BTC and other cryptocurrencies because they want not just assets with limited supply to counter inflation but also decentralized alternatives.

Investing in Bitcoin and cryptocurrencies as a whole simply makes sense, even for those who have no idea what blockchain technology is or how it works. We might not understand the code, but we know that Bitcoin owners have made profits during a pandemic. BTC value fell with the stock market in March 2020, but its evolution throughout the year was above all expectations. Moreover, in 2020 BTC performed 10x better than gold and outperformed most S&P 500 companies, including giants like Microsoft, Netflix, Amazon, or Alphabet.

The Institutional Support Validates Bitcoin’s Position

Pushed by the threat of inflation Wall Street showed its support for cryptocurrencies, too. When billionaires started to buy BTC to store value, skeptics and doubters paid attention. S&P 500 companies have purchased Bitcoin since January 2021, making the BTC price explode several times and reach new milestones each month.

Numbers and feelings pointed investors in the same direction. It was enough for Elon Musk to add “Bitcoin” to his Twitter bio to increase the demand for BTC — and, with the demand growing, the price surged again. Tesla, MicroStrategy, and Square own cryptocurrencies worth around $3.9 billion. The number gave investors more reasons to buy BTC and other cryptocurrencies.

What is the connection with the Federal Reserve printing more money? Elon Musk explained it on Twitter in February: “When fiat currency has a negative real interest, only a fool wouldn’t look elsewhere.”

Negative real interest occurs when inflation rates are higher than the nominal interest rate. S&P 500 companies fear inflation due to incense in money supply, so they invest in assets, and right now, Bitcoin is on the list of assets with limited supply that can outperform the market.

The correlation between the growth of the cryptocurrency market cap and how much money is being printed is there. One event alone cannot create the effects that we have seen on the crypto market, but it sure helped. It made the space for cryptocurrencies to appeal to investment banks and S&P 500 companies and increased trust in digital assets.